Customer Focus Drives the Reimagined Digital Experience Platform for Manappuram Finance Ltd.

Introduction

Manappuram Finance Ltd (MAFIL) has been a trusted partner for people needing gold loans in India. With the gold lending NBFC market becoming competitive with the entry of small and big players, MAFIL needs to differentiate its platform from competitors and build a strong digital presence to retain its leadership in this segment.

Challenges

Their custom-made legacy CMS could not handle the demands of their growing business, limiting their ability to provide a superior digital experience to their customers. Some of the key challenges they faced were:

- Inflexibility: The legacy CMS was not flexible enough to allow quick updates and changes to the website.

- Limited capabilities: The existing CMS lacked advanced content management, SEO, and 3rd party system integration capabilities.

- Poor user experience: The outdated CMS could not provide a seamless and personalized experience to the users, leading to a drop in customer satisfaction.

Our Approach

Market Research Methodology

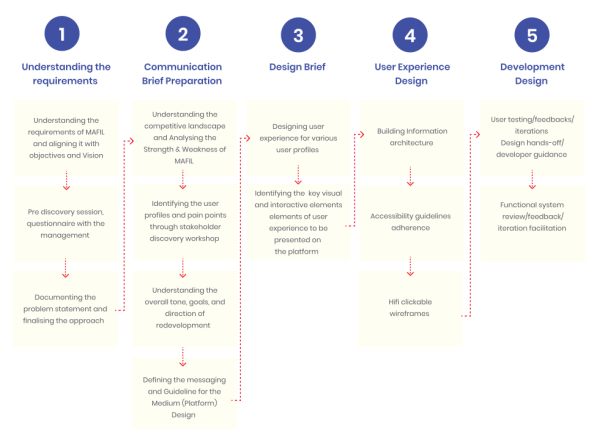

To achieve this, MAFIL entrusted Zyxware with developing the revamped platform. Zyxware followed a 3 step process to determine the communication strategy by identifying user-profiles and pain points, aligning the messaging, and outlining guidelines for the medium.

Target user segment and the chosen communication theme of convenience

The prominent user segment identified was people living in semi-urban and rural areas with low access to credit facilities from financial institutions. This user segment often does not have the required documents and is concerned with the high processing time to get the loan approved. Hence, convenience was the most prominent need gap for the segment. The same was chosen as the communication theme, highlighting the ease of loan processing, diversification of requirements, and competitive pricing.

Customer focus theme based on MAFIL's strengths and weaknesses and competitive analysis

In addition, Zyxware analyzed the strengths and weaknesses of MAFIL based on competitive analysis with other financial lending organizations in the debt market. After careful consideration, Customer focus as a theme was decided to highlight customer stories, pain points, and the benefits achieved by the customers.

Convenience to borrowers was understood along three axes:

- Ease of loan processing - Quickly processing with minimal documentation

- Catering to the diverse requirements - Various ticket sizes for multiple uses

- Competitive pricing - Maximum loan amount per gram with a low interest rate and no processing charge

Emphasizing convenience as a key selling point was used to differentiate MAFIL from competitors and attract more customers. In today's fast-paced world, convenience is highly valued, and customers are willing to pay more for products and services that save them time and effort. By positioning convenience as a key benefit, MAFIL wants to appeal to customers' desire for ease and simplicity.

Guidelines and objectives for the revamped platform

Guidelines with a customer-focused approach and messaging around convenience highlighting customer stories and pain points were defined.

By highlighting customer stories and pain points, MAFIL wants to understand its customers' experiences better and provide solutions that cater to their needs. This approach was used to build customer trust and loyalty, increased satisfaction, repeat business, and positive word-of-mouth.

Solution

Drupal as the DXP for Manappuram

The implementation of Drupal as the DXP for Manappuram Finance led to significant improvements in their digital capabilities and customer experience. Some of the key benefits Drupal offered were:

Improved website performance: Drupal's optimized code and caching mechanisms led to faster page load times and improved website performance.

Increased customer engagement: Drupal's personalized recommendations and advanced search capabilities helped to increase customer engagement and retention.

Reduced operational costs: Drupal's modular architecture and ease of maintenance led to reduced operational costs and faster time to market.

Result

The successful outcome of the revamp and the benefits of embracing digital transformation

The new platform developed by Zyxware provides a seamless experience to customers, making it easier for them to access information, apply for loans, and manage their accounts online. The platform is designed to provide customers with a more convenient and seamless experience, improving customer satisfaction and loyalty.

Improved User Interface (UI) and User Experience (UX)

The new platform's modern and intuitive design makes it easier for customers to navigate and find the information they need. The UI is also optimized for different devices, including desktops, laptops, tablets, and mobile phones, providing a consistent and seamless experience across all platforms. Before the UI was improved, the website was cluttered, confusing, and difficult to use. After improving the UI, the website has a cleaner layout, clearer navigation, and more straightforward information.

Read more on the UX process we have followed in A Human-Centered UX Approach to Lead Generation and Enhanced Customer Experience: A Case Study From Finance Sector

Online Calculators

Customers can now do various calculations online to decide the product that is most suitable for them. This eliminates the need to visit a physical branch or talk to a customer service executive to learn about the products.

Enhanced Security

The new platform uses the latest security protocols, including encryption and security best practices, to protect customers' sensitive information.

Mobile-friendly Responsive

The platform is designed and optimized to provide a seamless user experience across various devices with different screen sizes, resolutions, and orientations. The platform is designed to adapt and respond to the user's device, providing the best possible user experience regardless of the device used to access it. The mobile website layout did not provide a great user experience due to the difficulty in providing updates and announcements to be published quickly, ensuring reading content, small buttons to click. After the website became mobile-friendly, the layout was adjusted to fit the mobile device's screen, the text was larger and easier to read, and the buttons were larger and easier to click.

Easy Communication

The new platform provides a simple and intuitive interface for publishing content, making it easy to create and publish content quickly and easily. This ensures that content is always up-to-date and relevant, improving communication with customers and other stakeholders. With the old website, publishing content required technical knowledge or assistance from a web developer. This process was time-consuming and could cause delays in publishing important updates or announcements. The new platform helps to provide updates and announcements to be published quickly, ensuring that the website remains up-to-date and relevant.

SEO Friendly

The platform is built with features and elements that make it easy for search engines to crawl and index the platform, and it is optimized with relevant and high-quality content that will help it rank higher in search engine results pages (SERPs). Compared to the old website, the new website is designed with better site structure and navigation, making it easier for search engines to crawl and index the site's pages. This results in better visibility and higher rankings in search engine results in pages (SERPs).

The new digital platform has also enabled MAFIL to streamline its operations and improve its efficiency, resulting in cost savings and increased profitability. With the help of Zyxware, MAFIL has successfully transformed its digital presence and positioned itself as a leader in the digital financial services space.

The revamps of Manappuram Finance's digital platform by Zyxware Technologies have been a success story, resulting in enhanced customer experience, improved efficiency, and increased profitability. It is a testament to the power of digital transformation and the importance of staying ahead of the curve in today's fast-paced digital world.